The Top 20 Most Profitable Law Firms (2023)

Last year was a good one for Biglaw—especially for Wachtell Lipton, Quinn Emanuel, Susman Godfrey, and Cravath.

Welcome to Original Jurisdiction, the latest legal publication by me, David Lat. You can learn more about Original Jurisdiction by reading its About page, and you can email me at davidlat@substack.com. This is a reader-supported publication; you can subscribe by clicking here. Thanks!

In my analysis of last year’s Am Law 100 rankings, which reflected how firms fared financially in 2022, I predicted that 2023 was “not going to be good” for Biglaw. I took that view because 2022 was a weak year for law firms—and going into 2023, the economy was uncertain, inflation was still running high, and deal flow was weak on the corporate side.

But based on The American Lawyer’s 2024 Am Law 100 rankings, I’m happy to report that I was wrong. As Patrick Smith noted in his rankings write-up, in 2023 “the industry rebounded from a difficult 2022 to post gains in virtually every measurable financial and operational metric.” Here are the top-line numbers:

Total gross revenue: $139.7 billion, up by 6.8 percent.

Revenue per lawyer (RPL): $1.21 million, up by 4.9 percent.

Profits per equity partner (PPEP): $2.80 million, up by 9.3 percent.

Note that these figures are not adjusted for inflation. But the average rate of inflation in 2023 was 4.1 percent (and inflation ended the year at 3.4 percent), so these metrics—especially PPEP—outpaced inflation.

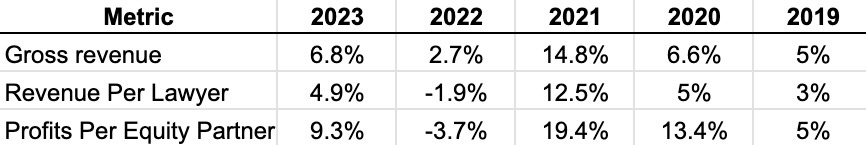

For purposes of comparison, here are the past five years of Am Law 100 performance:

As you can see, 2023 was much better than 2022, in which RPL and PPEP both declined, but worse than 2021, a banner year for Biglaw in which all three major metrics posted double-digit increases.

As for headcount, total headcount for the Am Law 100 rose 1.8 percent to 115,043 attorneys. The firms ranked #101-#200, whom Am Law refers to as the “Second Hundred,” employ an additional 32,070 lawyers. So the Am Law 200 firms—one way of defining “Biglaw”—employ a total of almost 150,000 lawyers. There are an estimated 1.3 million active lawyers in America, so somewhere between 10 and 15 percent of attorneys work in Biglaw. (I’m guessing that the actual number of truly “active” lawyers is lower than 1.3 million; that figure might include people like me, lawyers with active licenses who no longer practice, as well as semi-retired and other minimally practicing attorneys.)

[UPDATE (10:50 p.m.): A reader pointed out that the Am Law headcount totals include non-U.S. attorneys, which would throw off the percentage of U.S. lawyers who work for Am Law 200 firms. My main purpose with this stat was trying to figure out what percentage of U.S. lawyers work in “Biglaw.” If you look at the Law360 400, the largest U.S. law firms ranked by U.S. headcount, and add up the lawyers employed by all firms with 250 or more lawyers, which is another way of defining “Biglaw,” you get 129,922 lawyers. So the figure is probably still around 10 percent, but the description should be “percentage of U.S. lawyers who work for firms of 250 attorneys or more,” not “percentage of U.S. lawyers who work for Am Law 100 firms.”]

These are big-picture metrics. As Zach Sandberg and I discussed when we broke down the rankings on Movers, Shakers & Rainmakers, there’s a lot of firm-by-firm variability behind those numbers.

So let’s dig a little deeper into the three major metrics—gross revenue, revenue per lawyer, and profits per equity partner—and analyze how individual firms performed under each. As I typically do, I break out the top 20 firms in each category—but urge you to check out The American Lawyer, which does the heavy lifting of preparing these rankings, for more.

Keep reading with a 7-day free trial

Subscribe to Original Jurisdiction to keep reading this post and get 7 days of free access to the full post archives.